Warren Buffett energy stock Occidental Petroleum (OXY) reported conflicting financial results late on Tuesday, missing earnings expectations while exceeding revenue forecasts. Additionally, the oil producer disclosed that third-quarter investor returns totaled nearly $2 billion even though production was largely flat. After the market closed on Tuesday, OXY stock traded unchanged.

The report from Occidental Petroleum comes after fellow shale producer Diamondback Energy (FANG) reported beating earnings forecasts and returning nearly $900 million to shareholders.

Energy Stocks: Occidental Petroleum Earnings

Estimates: According to FactSet, Wall Street anticipated that Occidental Petroleum would generate $9.1 billion in revenue, a 34% increase in earnings per share, and earnings of $2.48 per share, a gain of 185%. Analysts projected $1.2 billion in capital expenditures, an increase of 100% from a year ago.

Results: When compared to the prior year, Occidental Petroleum’s EPS increased by 180% to $2.44. Sales increased by 40% year over year to $9.5 billion.

The oil producer claimed that during the third quarter, stock buybacks gave shareholders $1.8 billion back. OXY has given $2.6 billion in dividends to shareholders so far in 2022, according to the company.

The third quarter’s production of 1.18 million barrels of oil equivalent per day, an increase of less than 1% from Q3 2021, was reported by Occidental Petroleum to have cost $1.1 billion in capital expenditures.

OXY Stock

Late on Tuesday, the price of Occidental Petroleum increased by about 0.2%. Shares traded in a flat range of around 74.80 on Tuesday during market trading. OXY stock recently exceeded the 72.14 cup-and-handle buy point. MarketSmith analysis shows that the buy range goes up to 75.75. With its RS line at a three-year high, the energy stock OXY is currently outperforming the S&P 500.

The main business exposures for Houston-based Occidental Petroleum are oil, natural gas liquids, and natural gas. Additionally, it has a petrochemical segment that has had recent success.

OXY reported record second-quarter earnings in August, surpassing forecasts. 2. At $3.16 per share, Occidental’s earnings increased by 888%. To $10.7 billion, revenue rose by 81%. As oil production volumes stayed in line with expectations, that was primarily caused by rising oil prices.

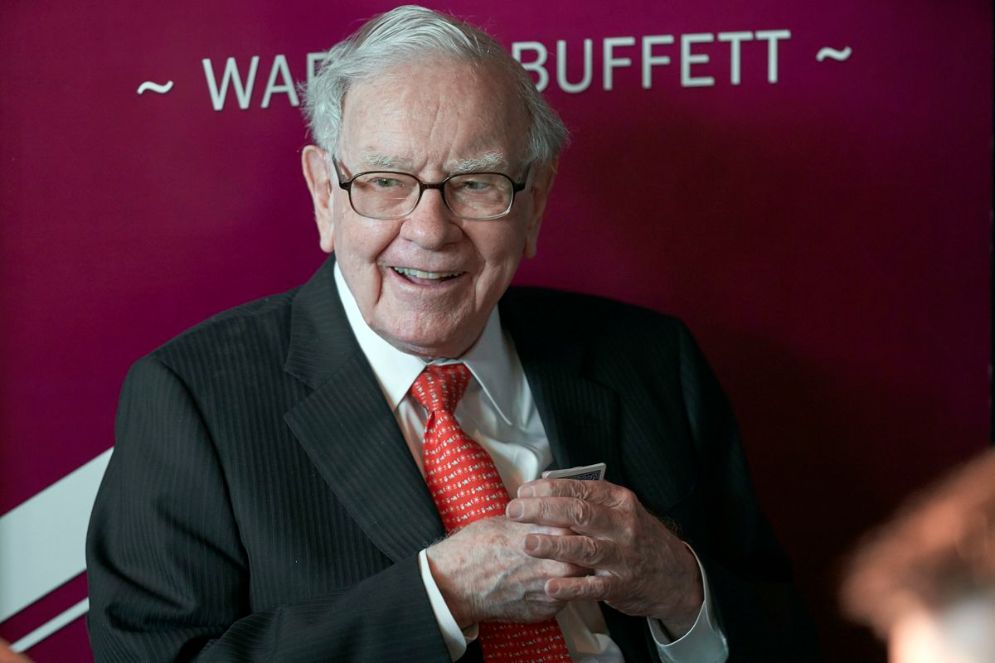

Billionaire investor Warren Buffett has been on an OXY stock buying spree this year, with his Berkshire Hathaway (Since July, the BRKA) has added more than 20 million shares to its holdings. According to SEC filings, Berkshire Hathaway has increased its OXY stake to about 21%, and it has warrants to increase its holdings above 25%.

In the industry category of Oil & Gas-International Exploration and Production, Occidental Petroleum is ranked fifth. OXY stock has a 99 out of 100 Composite Rating, which is flawless. OXY has an outstanding Relative Strength Rating of 98. A score of 80 EPS is assigned to the energy stock.

Energy Stocks: Diamondback Energy Earnings

Estimates: Diamondback Energy’s earnings were expected to soar 119% to $6.45 per share, according to the street. Analysts anticipated that revenue would increase 26% year over year to $2.4 billion in Q3. A $492 million capital expenditure was anticipated, up 26% from the previous quarter and 5% from the previous year. last year.

Results: EPS for Diamondback Energy increased by 120% to $6.48. Revenue for the third quarter totaled $2.4 billion, a 26% increase over the same period last year. Just below expectations, the company spent $491 million on capital projects.

In addition, Diamondback Energy disclosed that it paid dividends and repurchased stock totaling $874 million to its shareholders. This accounts for roughly 75% of the company’s third-quarter free cash flow of $1.16 billion.

The 390,630 barrels of oil equivalent per day that Diamondback Energy produced in Q3 were a 3% decrease from Q2 and a 2% increase from the same period last year.

“We focused on cost control, working to mitigate inflationary pressures associated with the variable components of our cost structure through improved operational techniques,” A statement from the CEO was released on Monday.

Fang Stock

Tuesday during regular market trading, Diamondback Energy stock marginally increased to 163.55. Monday saw a 1.3% increase in shares. MarketSmith analysis reveals that FANG stock broke out past an official 162.34 buy point from a cup-base pattern. However, that is 18% higher than the 50-day moving average. Since hitting a recent low of 110.97 on September, shares have surged 47%. 26.

The energy company, which is based in Midland, Texas, primarily produces oil but also engages in sizable natural gas operations. Earnings per share rose 194% to $7.07 in the second quarter. To $2.7 billion, revenue increased by 59%. In Q2, $468 million was invested in drilling projects, both operational and non-operational.

As well completion labor, materials, and services become more expensive and challenging to obtain, a large portion of drilling has been used to maintain output levels. Holding production steady has proven to be a successful strategy as a result of rising oil prices. According to analysts, Diamondback’s total 2022 earnings will increase 126% to $25.50 per share on an increase in sales of 41% to $9.6 billion.

In the Oil & Gas-U.S., the shale energy stock Diamondback Energy is ranked ninth. Industry Group for Exploration and Production. The perfect Composite Rating for FANG stock is 99. The stock has a 96 Relative Strength Rating, an exclusive IBD Stock Checkup indicator of share-price movement. The EPS rating is 95.

Energy Stocks And The Oil And Gas Market

While President Joe Biden has increased his criticism of oil producers, the financial reports from OXY and FANG also come as oil prices begin to rise once more.

In order to reduce consumer fuel costs, Biden has urged businesses to pay higher taxes. Additionally, the president declared on Friday that he would soon meet with oil companies face-to-face.

U.S. crude oil futures fell 2.8% on Tuesday to $89.17 per barrel, returning to below the $90 level. The first monthly increase since May, prices increased by nearly 9% in October. The Organization of the Petroleum Exporting Countries and its major allies, including Russia, are collectively known as OPEC+, and as of the beginning of November, a 2 million barrels per day production cut from them is officially in force.

The cost of natural gas in the United States dropped 8.5% to $6.63 per million BTUs. Futures increased 4.6% on Monday. Since the beginning of the year, U.S. natural gas futures have increased by about 53%. They have fallen off from August’s 14-year highs by about 40%, though.

Diamondback Energy and Occidental Petroleum’s financial outlooks for this week come in the wake of a number of energy stocks that reported earnings last week.

Devon Energy (DVN) reported that third-quarter sales increased 20% to $4.15 billion, with EPS increasing 96% to $2.18. Energy stock Marathon Oil (MRO) topped earnings and sales views, and energy stock Marathon Petroleum (MPC) reported a 969% increase in earnings or $7.81 per share. The week prior, Pioneer Natural Resources (PXD) exceeded earnings expectations but fell short on sales.

Reference: https://www.investors.com/news/diamondback-energy-warren-buffett-stock-occidental-earnings/